New measures, including tax increases of Rs215 billion, will go into effect on July 1 after Acting President Sanjrani signs the Finance Bill 2023-24.

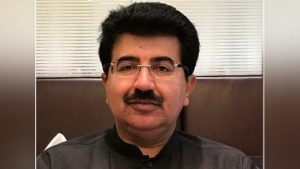

The Finance Bill 2023-2024, as amended by the National Assembly and with a revised outlay of Rs14.48 trillion, was signed into law by Acting President Sadiq Sajrani on Monday in Islamabad.

Economic stability, sustainable and inclusive growth, and price control are priority areas in the recently passed budget for 2023–24.

Added to the original law that was introduced on June 9 were new levies totaling Rs215 billion. The legislation established a GDP growth rate target of 3.5%.

With support from Finance Minister Ishaq Dar, the House of Representatives unanimously passed the law the day before. As the budget was passed, the banging of desks could be heard throughout the room. The new start date for the Finance Act is July 1.

Dar, in a last-ditch effort to get a long-delayed rescue package from the International Monetary Fund (IMF), announced fiscal modifications costing Rs300 billion, which were accepted the day after Dar’s budget.

Dar’s announcement of fresh measures as the budget debate came to a close indicated that the government had agreed most of the IMF’s demands, such as raising taxes on the salaried class and ending the $100,000 asset-whitening plan.

In light of Rs215 billion in additional taxes, the Federal Board of Revenue (FBR) saw a need to increase its revenue collection objective in the approved Finance Bill.

Budget increases for the Benazir Income Support Programme (BISP), the National Finance Commission (NFC) payment to the provinces, and the pensions of retired government employees were all approved by the House.

The federal excise duty (FED) on fertiliser was raised from five percent to ten percent, the tax on the sale and acquisition of real estate was raised from one percent to two percent, and the FED on juices was raised from ten percent to twenty percent.

The Petroleum Development Levy Ordinance was revised to raise the maximum PDL rate from Rs50 per litre to Rs60 per litre.

Fans with antiquated technology were subject to a Rs2,000 levy as of January 1, along with a 20% tax on incandescent light bulbs.