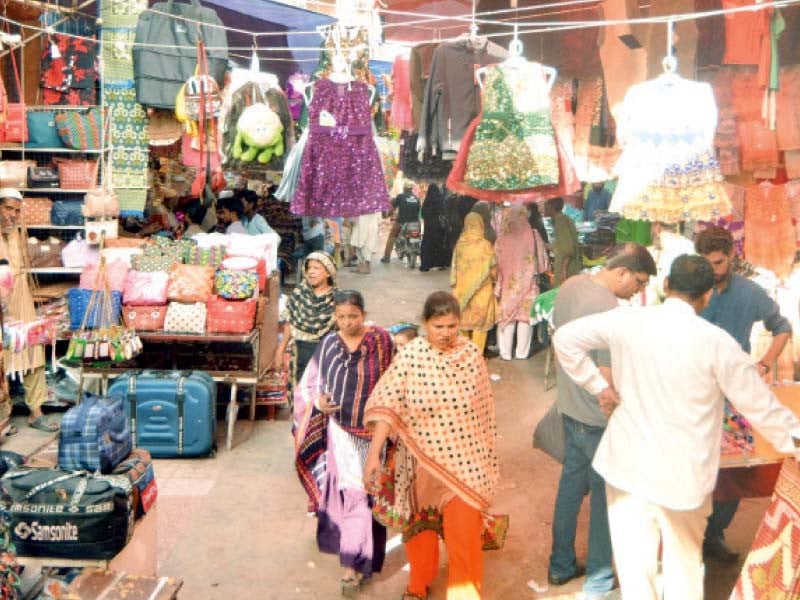

ISLAMIC CITY:

As a result of the move to stop the SIMs of non-filers, the number of retailers in the country registered under the Tajir Dost Scheme has gone up. By May 30, there were a total of 21,870 registered retailers, according to data released by the Federal Board of Revenue on Friday.

The most stores were listed in Lahore, with the next most in Karachi.

Statistics show that there are 6,706 retailers in Lahore who have signed up for the plan.

In the same way, 5,512 stores have been listed in Karachi.

2.742 stores have been registered in Rawalpindi, and 1.927 have been registered in Islamabad.

Another 1,857 stores in Peshawar, 1,226 in Quetta, and 1,900 in other cities have also signed up for the plan.

It was announced by the government in March of this year that stores and wholesalers would have to register for taxes.

An FBR notification says that the plan will apply to traders and shopkeepers who run their businesses out of a fixed place of business, such as a store, shop, warehouse, office, or other similar building within the civil limits of the territory, including cantonments.

It also said that all sellers who don’t file taxes would apply to be registered under Section 181 of the Income Tax Ordinance 2001.

But the traders didn’t like how the plan required sellers who didn’t pay taxes to put down a monthly advance tax.

The FBR thought that the plan would bring three million retailers into the tax system, but as of April 30, it had only been able to find 75 to 105.

But the move by the tax system to block the SIMs of people who don’t pay taxes seems to have worked.