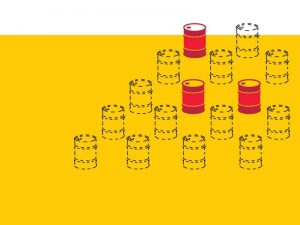

The majority of Pakistan’s oil and gas reserves have been used up.

The country’s energy prognosis is grim due to the fact that 80% of oil deposits and 67% of gas deposits have been consumed.

ISLAMABAD:

Pakistan has used up 79.8% of its oil reserves and 66.6% of its gas reserves, making the future of its energy supply look dismal.

Pakistan has used 985 million barrels, or 79.8%, of its 1,234 million barrels of oil reserves, according to a report the Petroleum Division filed to the Auditor General of Pakistan (AGP). Currently, there are about 249 million barrels of reserves left.

According to the Petroleum Division, Balochistan has 1.84 million barrels of recoverable oil reserves, 0.24 million of which have been used, leaving 1.60 million barrels. 170.59 million barrels of the 264.83 million barrels of recoverable reserves that Khyber-Pakhtunkhwa (K-P) had were used. There are now only 94.24 million barrels available.

Punjab has 457.43 million barrels of initially recoverable reserves, of which 383.20 million barrels have been used and 74.23 million barrels are still to be put to use.

From the projected 509.58 million barrels of recoverable reserves in Sindh, the province has used 430.60 million, leaving 78.98 million barrels.

In comparison to the aim of 30 million barrels, Pakistan’s oil production was 27 million barrels in the fiscal year 2020–21, or 90% of the target.

Pakistan has been a significant gas producer in compared to oil to suit domestic demand. The nation was previously self-sufficient, but since 2015, due to the introduction of gas supply plans motivated by political reasons, it has started importing liquefied natural gas (LNG). Pakistan has used up 66.6% of the entire gas reserves, according to the Petroleum Division’s report, leaving 33.4% of the reserves untapped.

Since 2000, exploration and production (E&P) firms have not been able to increase gas production, and they have also made few significant finds.

Natural gas reserves in Pakistan were around 63 trillion cubic feet (tcf), of which only 42 tcf have been used. The Planning Commission reported that compared to the aim of 1.43 tcf, gas production was at 1.27 tcf annually.

According to provincial data, Balochistan has recoverable reserves totaling 20.637 tcf, of which 15.182 tcf had been used up, leaving 5.455 tcf (26%) in reserve.

K-P had 2.932 tcf in total recoverable reserves; 1.186 tcf (or 40%) of this amount) has been burned.

Punjab had 3.977 tcf in total recoverable reserves. Out of them, 2.379 tcf have been used, leaving 1.598 tcf (or 40%) in reserve.

35.5% of the recoverable deposits are still in Sindh. It has 35.765 tcf in total reserves, of which 23.053 tcf had already been used up and 12.712 tcf was yet untapped.

One of the main sources of energy in Pakistan is natural gas, which accounts for 33% of domestic production, 10% of LNG, and 1% of liquefied petroleum gas (LPG).

The limited domestic reserves of natural gas have been depleted over the past many years by a 5% yearly rise in demand.

According to the Petroleum Division’s assessment, one of the primary causes of the nation’s growing natural gas supply and demand imbalance is the rapid depletion of the country’s current reserves in the absence of any significant new discoveries since 2001.

A deficit of 0.507 tcf is revealed when domestic production is computed at 1.263 tcf per year compared to consumption of roughly 1.770 tcf.

0.382 tcf (8.1 million tonnes) of LNG is imported to make up the difference. The proportion of LNG in the supply of natural gas has increased over time to 29%.

At the moment, the reduction of gas supply, or load management, to various economic sectors is used to address a net shortfall of 0.125 tcf.

AGP also raised a number of concerns with the Ministry of Energy. It stated that there were various regulators overseeing the E&P industry. In order to cope with the E&P sector, the director general of petroleum concessions develops and implements petroleum policies, E&P regulations, and petroleum concession agreements (PCAs).

Lack of an independent upstream regulator has caused excessive delays in lease extensions, the awarding of E&P blocks and their cancellation, and the distribution of oil and gas to buyers.

Similar reasons for not allocating crude oil and gas to refineries and Sui companies, as well as for not finalising gas sale and purchase agreements, include ineffective monitoring of production and sale, partial or non-implementation of petroleum policies, PCAs, rules/guidelines, and field development plans of E&P companies.

The delayed exploration and production of hydrocarbons is one of the issues the E&P sector is facing. Unfavorable security circumstances in the exploration zones result in additional costs, property damage, and disruption of E&P operations. Over time, it was impossible to rationalise the variable E&P expenditures associated with low and decreasing reserves.

Due to extremely high costs and a lack of service providers or technology, unconventional energy sources like shale gas and tight gas have not been exploited.

Many E&P businesses’ projects either ran behind schedule or failed to meet their production goals. Production has occasionally been halted as a result of storage facility installation that wasn’t coordinated. Furthermore, unjustifiable or unneeded purchases blocked funds, which ultimately resulted in wasteful expenditures.